OnPay: Fast Facts [Star rating: 4.2 out of 5] Pricing: $40 per month + $6 per payee per month Key features:

|

Jump to:

- OnPay’s pricing

- OnPay’s key features

- OnPay pros

- OnPay cons

- Alternatives to OnPay

- How we evaluated OnPay

- Is OnPay right for your organization?

OnPay is a cloud-based, full-service payroll software solution that enables small and midsize businesses to manage payroll, tax filing, benefits administration and other human resources processes. Along with its flat cost, OnPay’s easy-to-use platform, free expert setup and HR tools make it an affordable payroll pick for businesses in most industries.

With just one plan, OnPay likely isn’t scalable enough for most big businesses and enterprises. Its minimal integrations also limit its accessibility for companies that use accounting software other than QuickBooks and Xero.

However, as far as payroll and HR software solutions go, OnPay is easily one of the most affordable and most functional. In our OnPay review, we’ll delve deeper into which types of businesses can benefit the most from OnPay’s payroll and HR service.

OnPay’s pricing

OnPay costs a flat rate of $40 per month and $6 per month per person paid. It has far fewer extra fees than competitors like Paychex, while bundling more HR features into its base cost than ADP and Gusto include with their mid-tier and even premium-level plans.

Additionally, OnPay offers a month-long free trial for all new users. The free trial includes free white glove setup where OnPay’s experts will migrate or add your employee data to ensure accuracy.

OnPay’s key features

Payroll features

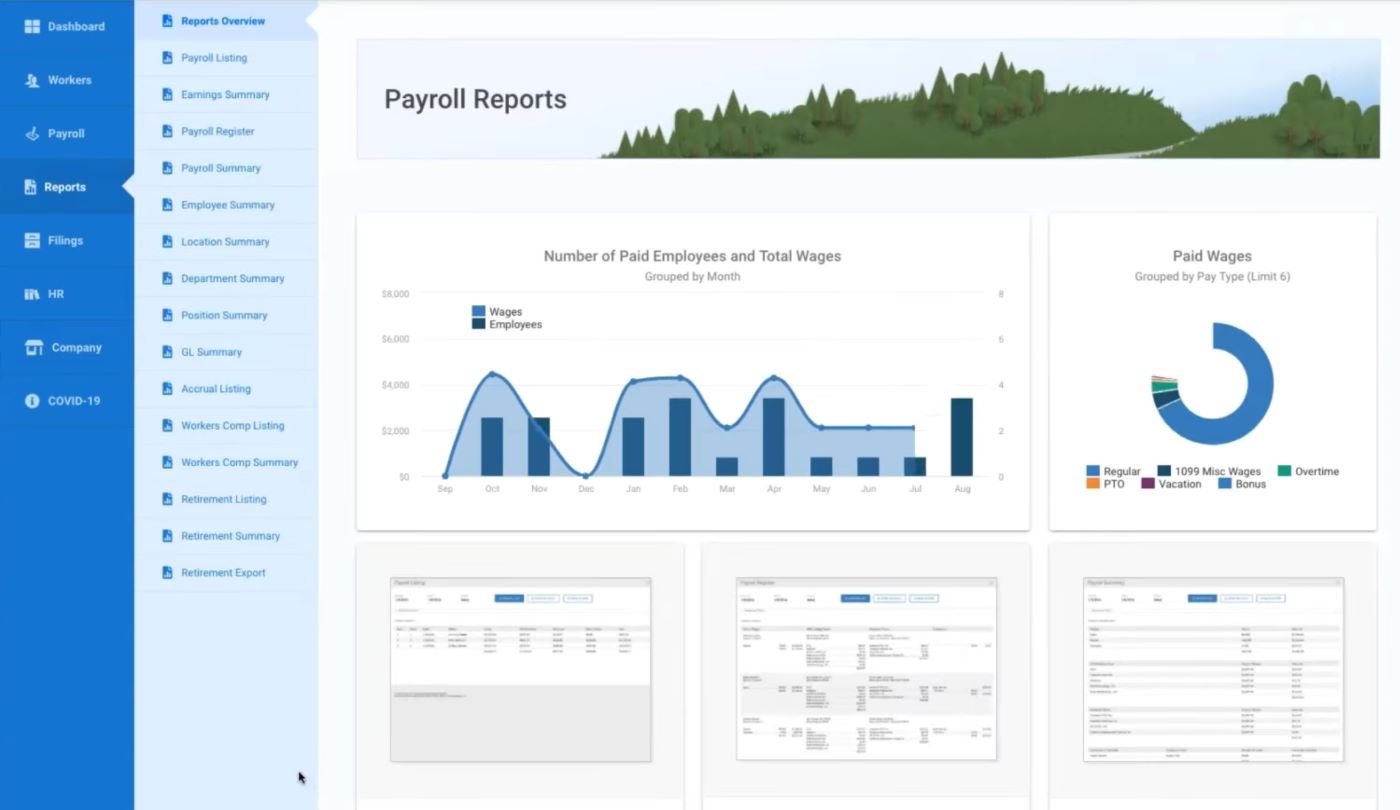

OnPay offers a wide variety of features to support business payroll workflows, including garnishment deductions, automated tax payments and payroll reporting (Figure A).

Figure A

The OnPay platform simplifies tax filing by withholding all payroll taxes each pay run. In addition, OnPay automatically files all federal taxes, including quarterly 941s and annual Forms W-2, W-3, 1099, 940 and 943.

OnPay also files state payroll taxes and files all applicable local payroll taxes. These automated tax features can save business leaders time and effort while reducing the risk of making tax errors.

HR features

Although OnPay is a payroll-first solution rather than a hybrid HR and payroll HCM service, it includes a range of helpful HR features that either cost extra or are overlooked entirely by competitors like Gusto.

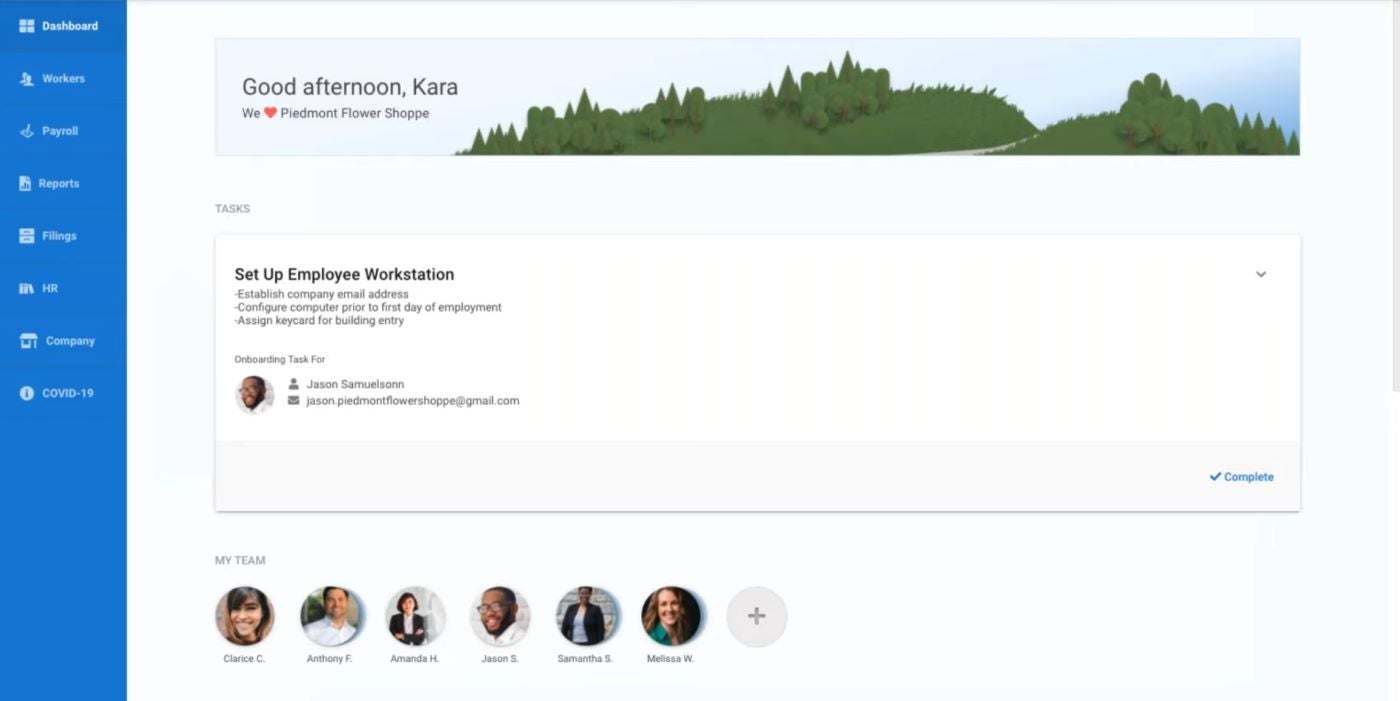

Most notably, OnPay’s HR tools let businesses manage employee benefits, conduct traceable conversations within the platform and onboard new staff members. The platform supports each step of the onboarding process by allowing businesses to send customizable job offer letters and set up employee workstations (Figure B).

Figure B

OnPay’s solution also automatically reports new hires to the state when they set up their OnPay accounts. From there, new workers can easily use OnPay’s automated onboarding flows to fill out their profiles, e-sign HR documents and perform other onboarding tasks directly within the system.

SEE: Best onboarding software for new employees in 2023 (TechRepublic)

Integration with third-party solutions

Businesses can integrate OnPay’s payroll data with popular accounting systems like QuickBooks Online and Xero to create custom item mapping and add detailed journal entries to their general ledger. Likewise, OnPay’s integrations with timekeeping tools like Deputy and QuickBooks Time lets business leaders access time and attendance data to generate reports and manage workers’ paid time off.

Employee self-service tools

Employees can use OnPay’s self-service tools to carry out their own self-onboarding processes, like submitting personal information, signing offer letters and setting up direct deposits. The employee-self-service portal allows workers to access payroll information and even view pay stubs and personal tax documents after leaving the company.

Industry-specific payroll plans

OnPay offers several industry-specific payroll plans with features custom-made for businesses in the following niche industries:

- Farms and agricultural businesses

- Restaurants

- Churches

- Nonprofits

The company also has a payroll plan for enterprises with more than 500 employees.

OnPay pros

Unlimited pay runs: OnPay offers unlimited monthly pay runs and helps businesses process their payroll, with support for multiple pay rates and schedules, tax filings and garnishments.

Free multi-state payroll: OnPay is available in all 50 U.S. states. In contrast to nearly all of its main competitors, QuickBooks Online Payroll and Gusto included, OnPay offers multi-state payroll at no additional cost.

Benefits management: With OnPay’s employee benefit management tools, businesses can support their employees with attractive perks like health insurance and 401(k) retirement plans. Paycheck deductions for benefits are made automatically. OnPay’s in-house brokerage can help companies find health and dental insurance and workers’ compensation plans in all 50 states.

Integration with popular solutions: OnPay integrates with popular business software such as QuickBooks Online, QuickBooks Time, Xero and Deputy, making it easy to link data from other software systems.

Responsive customer service: While OnPay doesn’t offer live 24/7 customer support, it does have extended customer service hours. You can also get in touch with OnPay’s customer support team over the phone between 9am and 8pm ET every weekday, and emergency email support is available on weekends. OnPay’s customer service includes free software setup for each new user.

OnPay cons

No built-in time tracking: OnPay’s software does not provide built-in time tracking features. However, OnPay integrates with a handful of third-party time tracking software solutions, such as QuickBooks Time, Deputy and When I Work.

Form distribution fees: OnPay charges a fee to print and mail annual W-2 and 1099 forms to workers directly on behalf of the business. This fee is fairly standard across the payroll industry, and companies can self-print and distribute these pre-filled (by OnPay) tax forms at no cost.

No auto-pay option: OnPay provides no auto-pay option, so it may not be ideal for businesses that want to automate their payments to salaried employees.

No mobile app: While OnPay’s site is mobile-friendly, it doesn’t offer a payroll app for employers. OnPay’s app for employees has limited functionality and is poorly reviewed on both Google Play and the App Store.

SEE: Best payroll software for your small business in 2023 (TechRepublic)

Alternatives to OnPay

Gusto

Gusto is another full-service payroll provider offering software designed for small businesses. The solution automates payroll tasks for employees and contractors to simplify payroll processes for business owners. Gusto also provides employee benefits and features to help with tax filing and reporting, onboarding and tracking time and expenses.

Pricing

- Simple plan: Starts at $40 per month, plus $6 per month per employee.

- Plus plan: Starts at $80 per month, plus $12 per month per employee. As a limited time offer, for the first six months of service, the Plus plan is priced at $60 per month, plus $9 per month per employee.

- Premium plan: Pricing for this plan is available upon request.

ADP

ADP is a human capital management service provider that offers payroll, HR, talent management, and tax and benefits administration solutions. ADP automatically generates and sends W-2 and 1099 forms to employees and contractors and provides HR features like automated timekeeping, schedule building, and shift management tools.

Other perks to ADP’s HR and payroll software include labor law compliance, customizable reporting and integrations with more than 100 systems.

Pricing

These four RUN Powered by ADP packages are suitable for small businesses with one to 49 employees:

- Essential provides basic payroll features for startups and established companies.

- Enhanced includes basic payroll features plus ZipRecruiter, state unemployment insurance and background checks.

- Complete includes all of the Enhanced package features, plus basic HR support.

- HR Pro comes with everything included in the Complete package, plus enhanced HR support.

The three ADP Workforce Now packages are optimal for businesses with more than 50 employees. You can choose between these Midsized & Enterprise Payroll and HR plan options.

- Essential provides the basic capabilities needed to streamline payroll and HR in an all-in-one suite.

- Enhanced provides everything included in the Essential package as well as additional features to simplify benefits administration and save time.

- Premium includes the capabilities of the Enhanced package and provides automated time tracking with Workforce Management.

SEE: Payroll services comparison tool (TechRepublic Premium)

Paychex

Paychex is a payroll provider that offers software products to help small business owners meet their HR needs. Its features support processes relating to payroll, tax management, benefits administration, compliance, and talent acquisition. Much like OnPay, Paychex is an easy-to-use platform for businesses seeking to optimize their employee management.

Pricing

- Paychex Flex Essentials: $39 per month, plus $5 per employee.

- Paychex Flex Select: Pricing information is available upon request.

- Paychex Flex Pro: Pricing information is available upon request.

1 Deel

Deel's full-suite of HR tools allows companies to manage the entire employee lifecycle—from recruitment and onboarding and beyond—in 150 countries. All this from a single, easy to use interface. US and Global Payroll allows you to pay any type of worker in 100+ countries, and all 50 states, in whatever currency you choose. And with 200+ in-house legal experts and entities in 120+ countries, using Deel means you’ll always be compliant with local regulations.

How we evaluated OnPay

Our OnPay review is a technical piece based on compiled literature researched from relevant databases. The information provided within this article is gathered from vendor websites or based on an aggregate of user feedback to ensure a high-quality review.

We calculated OnPay’s overall star rating of 4.2 from the following metrics:

- Pricing (weighted to 25% of the total score): 4.2 out of 5.

- Core features (weighted to 35% of the total score): 4.25 out of 5.

- Ease of use (weighted to 15% of the total score): 3.45 out of 5.

- Customer service (weighted to 15% of the total score): 4.5 out of 5.

Our expert’s opinion (weighted to 10% of the total score) also contributed to our final star rating for this OnPay review.

Learn more on our in-depth payroll methodology page, which explains our scoring rubric. Specifically, it dives into our research methods and the criteria we use to evaluate each brand’s scores in the categories above.

Is OnPay right for your organization?

OnPay is best for small and midsize businesses looking for a comprehensive and reliable payroll and HR software solution.

OnPay’s user-friendly interface and simplified support for payroll processing, tax filing and employee benefits management make it particularly suitable for businesses that are new to payroll and HR software. OnPay is also an ideal solution for businesses that want industry-specific payroll services in fields that include farming, nonprofit and restaurant services.

But if you’re looking for thorough workforce management tools, employee feedback features or international payroll, OnPay doesn’t have what you need. Instead, look at enterprise-level solutions like Workday HCM, Ceridian Dayforce or ADP Workforce Now.

Alternatively, if you only have one to five employees and believe OnPay has too many features for your needs, consider a more streamlined, more affordable solution like SurePayroll or Patriot Payroll.

Read next: Top payroll processing services for small businesses in 2023 (TechRepublic)